The November 2018 election in Georgia’s 6th Congressional District has been over for months, but one of the most controversial aspects of one newly-elected Congresswoman’s residency has only recently been settled.

AllOnGeorgia reported back in October 2018 that then-congressional candidate Lucy McBath and her husband, Curtis, were set to have their homestead exemption in Cobb County revoked by the county tax commissioner’s office because they did not meet the requirements for primary residency. The proposal for revocation was appealed by the McBath’s and the final decision was not made before Election Day on November 8th.

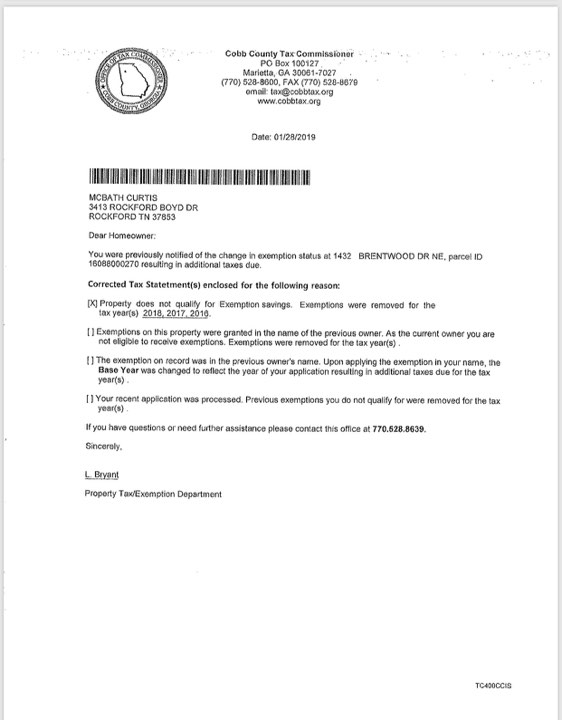

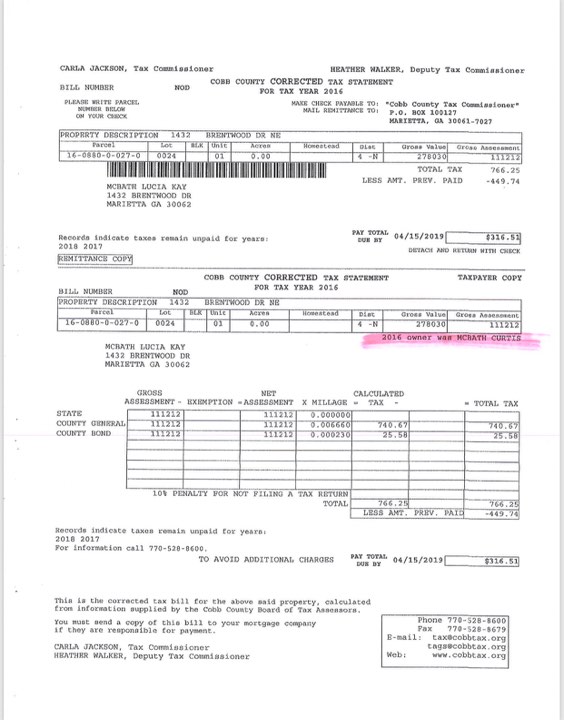

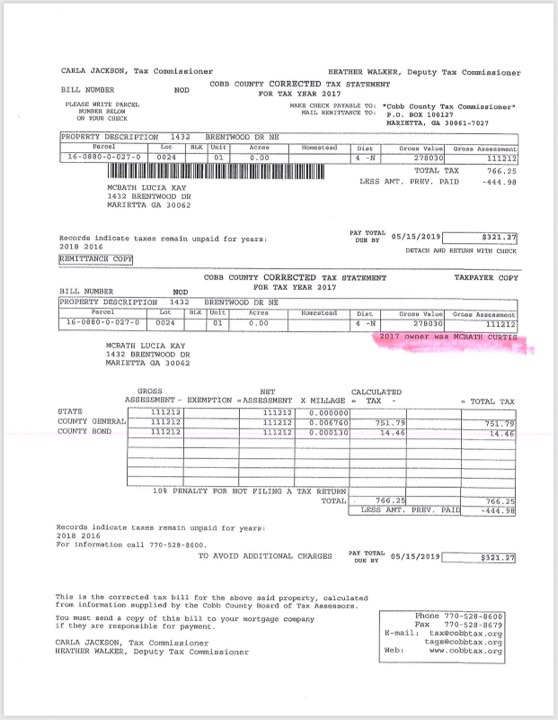

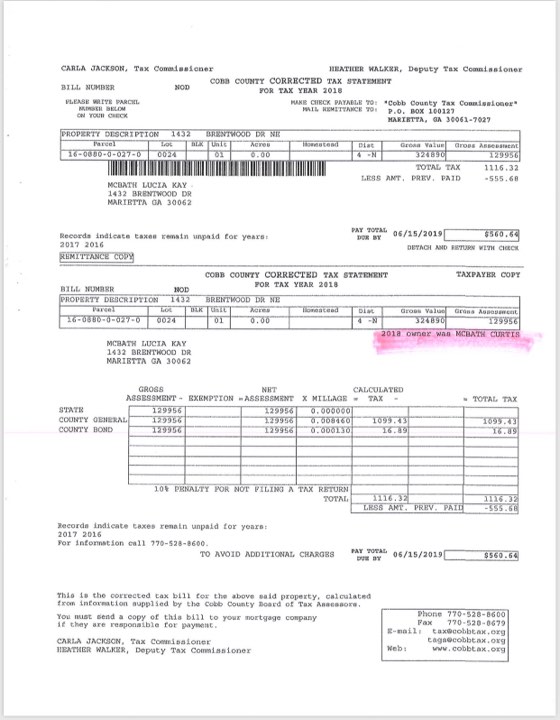

But the Cobb County Tax Commissioner’s Office confirmed Tuesday that the McBath’s homestead exemption in Cobb County was, in fact, revoked for the tax years 2016, 2017, and 2018 – the year McBath ran for Congress and won – and back taxes were assessed. The audit on the homestead exemption dated back to 2015, but Georgia law only permits a three-year lookback.

The final decision: the McBath’s did not meet the requirements to call Cobb County their primary residence for the three tax years leading up to the election. The reasons cited included:

- having tags/drivers licenses in another county/state

- having voter registration in another county/state

McBath, who narrowly defeated Republican Karen Handel, publicly said she ‘recently moved back to the district’ after living in Tennessee, but her husband Curtis McBath had been claiming a homestead exemption in Cobb County for the last 16 years, even though many documents that would otherwise verify residency in Georgia are legally recorded in Tennessee.

Ultimately, the Tax Commissioner assessed over $1,197 in taxes due to the county for the three year lookback in which homestead exemptions were wrongfully claimed. The Commissioner’s office confirmed Tuesday that the taxes had since been paid.

All of the documents as provided by the Cobb County Tax Commissioner are provided below.

A Georgia homestead exemption primer and a background on McBath’s residency

A homestead exemption is, by definition, a protection of the value of a home from property taxes and creditors. One must be a permanent resident of Georgia to claim a homestead exemption in Georgia and, under Georgia law, a married couple is deemed to be a single applicant, meaning jointly, only one property qualifies to receive a homestead exemption. Most homestead exemptions use a monetary value to determine property tax protection, implementing a progressive-style tax to home value in order to assure that homes with lower assessed value benefit the most from the exemption.

McBath was criticized during the election cycle over inconsistent comments about her residency in recent years, saying in an Atlanta Press Club debate in May 2018 that she has been a resident of Georgia since 1990, but records indicate she voted in Tennessee in 2016, and then reverted back to Georgia voting in 2017. The Tennessee Secretary of State’s office confirmed in July 2018 that McBath registered to vote in Tennessee again on March 23, 2016, but the McBath campaign claims Lucy voted for herself in May and July of 2018.

The Blount County Tax Office in Tennessee indicated that Curtis McBath owns three parcels of land in the county and Lucy McBath said on more than one occasion that her husband is a ‘permanent resident’ of Tennessee. The Atlanta Journal Constitution reported in 2018 that Curtis McBath has been registered to vote in Tennessee since 1991. And despite the televised claims of permanent residency, no attempts have been made to update the status of the homestead exemption in Cobb County, which has been claimed since 2002 – a whopping 16 years.

So why the homestead exemption claim in Cobb County?

In October, AllOnGeorgia requested the correspondence between the Cobb County Tax Commissioner’s Office and the Lucy and Curtis McBath after allegations that the McBaths were double dipping on homestead exemptions.

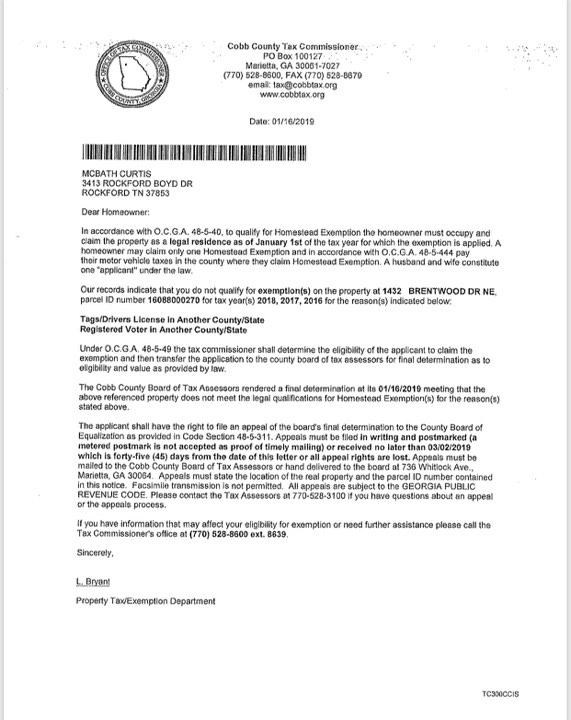

A letter dated October 10, 2018 provided to AllOnGeorgia by the Cobb County Tax Commissioner’s office, defined as an ‘audit letter,’ indicated that the Tax Commissioner’s office determined that the McBaths did not qualify for a homestead exemption in Cobb County anymore.

The audit letter was sent to the McBaths at an address in Rockford, Tennessee (which is among the properties owned by McBath in Tennessee, per the Blount County property tax records) but details the property in question on Brentwood Drive in Marietta. At the time, the property tax records from Blount County, TN listed the Marietta address as the correspondence address for Curtis McBath. The Marietta address was the same one on which Curtis McBath has claimed a homestead exemption since 2002.

The letter specifically stated that the homestead exemption for the tax years beginning in 2015 and ending in 2018 will be removed from the homestead exemption list and indicates that the burden to update the exemption status is on the property owner and the taxpayer.

The reasons include for disqualification include:

- Motor vehicle registration(s) reflect a change of primary residence,

- Registered voter information reflects a change of primary residence, and

- Driver’s license reflects a change of primary residence.

It is unclear as to whether or not the homestead requirements have been resolved for tax year 2019.

MCBATH, CURTIS audit letterMcBath

DOCS: Ga Congressional Candidate Disqualified from Homestead Exemption, Tax Office Investigating

Jessica Szilagyi is a former Statewide Contributor for AllOnGeorgia.com.

3 Comments

Leave a Reply

Cancel reply

Leave a Reply

Chattooga Local News

TRION PUBLIC LIBRARY RECEIVES NATIONAL GRANT FOR SMALL AND RURAL LIBRARIES

Bulloch Lifestyle

41st Annual ArtsFest at Sweetheart Circle Saturday, April 20

Bulloch Public Safety

04/19/2024 Booking Report for Bulloch County

Bulloch Lifestyle

Adoptable Pet of the Week Re-Feature: Tucker

Georgia News

Kemp Signs Historic Tax Cut Package Into Law

Bulloch Public Safety

03/25/2024 Booking Report for Bulloch County

Bulloch Public Safety

04/09/2024 Booking Report for Bulloch County

Bulloch Public Safety

04/01/2024 Booking Report for Bulloch County

Bulloch Public Safety

04/08/2024 Booking Report for Bulloch County

Bulloch Public Safety

04/15/2024 Booking Report for Bulloch County

Lizzie warren

March 27, 2019 at 9:44 am

Typical democrat tactics

Renee Wright

March 29, 2019 at 12:20 pm

What can be done to have her removed from office?

Croge

April 2, 2019 at 3:35 pm

Just typical liar on the left and of a protected class and female… all the requirements met for another entitled black woman crook on the left being grossly dishonest to get elected by dumb white people on a guilt trip! We are truly screwed!!!