Bulloch County Schools: “Board makes difficult decision to raise millage rate, 1.174 mill increase qualifies Board to continue receiving state equalization funding”

In a called session on Sept. 8, the Bulloch County Board of Education voted 7-1 in favor of raising its 2023 Maintenance & Operations (M&O) Millage Rate by 1.174 mills in order to continue qualifying for the equalization grant received through the state’s Quality Basic Education formula.

This millage rate increase is not an effort designed to increase revenue or make up a budget shortfall. Instead, it is an intentional effort to avoid losing $7.4 million in annual state equalization grant funding that also inadvertently generates $3.4 million in additional property tax revenues that were not budgeted for the current fiscal year.

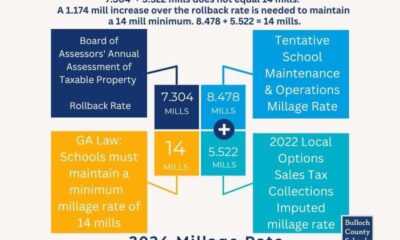

State law (O.C.G.A. 20-2-165) requires that school boards maintain a minimum M&O Millage Rate of 14 mills in order to qualify for state equalization grant funding. Simply put, the purpose of the board’s action was to protect the sustainability of district programs and personnel that serve the students of Bulloch County Schools, and not a desire to harm the citizens of Bulloch County as some advocates have expressed.

Bulloch County Schools receives our county’s Local Option Sales Tax (LOST), which has an imputed millage rate of 5.522 mills. The school district’s M&O Millage Rate plus the imputed LOST millage rate must equal at least 14 mills to qualify for state equalization grant funding. When the rollback millage rate information was received from the Bulloch County Tax Assessor’s Office in late July, it was determined that the sum of the rollback rate of 7.304 mills and the imputed LOST millage rate of 5.522 mills fell short of the 14 mill requirement by 1.174 mills, triggering the board’s public hearing process and subsequent approval of 8.478 mills.

While some surrounding school districts may have rolled back their millage rate, their rates still remain significantly higher than Bulloch County’s, which is the lowest in our 17-County area and the fourth lowest in the state. It is also the school district’s second lowest millage rate in the last 10 years.

“The unfortunate irony in all of this is that because we’ve kept school property taxes so low, we have now run up against the 14 mill floor required to continue qualifying for state equalization grant funding,” Wilson said.

The Board’s decision, which came after six public hearings, resulted in the school district increasing the M&O portion of its millage rate by 1.174 mills over the Bulloch County Tax Assessor’s rollback rate of 7.304 mills. For property owners with homestead property that has a fair market value of $225,000, it will increase the annual taxes on that property by approximately $103.31. For non-homestead property with a fair market value of $200,000, the increase will be approximately $93.92.

“Boards of Education serve a unique and difficult role that is different from other elected bodies across the state in which they must balance fiscal policy, along with various other factors, while maintaining their primary commitment to serving students.” said Charles Wilson, superintendent of schools. “I know this vote weighed heavily on all of us, especially our board members.”

The Board deliberated for 45 minutes prior to Chairman Glenn Wommack calling for the vote. The discussion began with a question from District 3 Representative Stuart Tedders,Ph.D., who asked about what the school district would experience should the Board vote to not raise the millage rate and subsequently lose its $7.4 million in annual state Equalization Grant funding. Tedders also expressed that contrary to what some people may say, the Board does care, and it does not take these decisions lightly.

Wilson noted that 85% of the school district’s budget is employee salaries and benefits, three to four percent is energy costs, and another five percent is related to instructional materials for teachers and students.

“If we chose to willingly lose $7.4 million in state funding, we’d be looking at unprecedented cuts to our budget,” Wilson said. “I go back to 2008, and the 10 furlough days we had to activate in response to the state cutting our funding. A loss like this would result in even more aggressive cuts ranging in variety across the district.”

In response Donna Clifton, the Board’s District 4 representative said, “I ran for the kids of this county, and they are my top priority. We’ve heard the community, and we feel the same pain, but school boards are different from other elected officials.”

Clifton was referring to school boards being the only elected special purpose local government in Georgia. According to the Georgia School Boards Association, while other elected officials are considered general purpose local government, school board members are required by law (O.C.G.A. 20-2-49) to represent all voting districts in their school system, not just their individual district, and their motivation is to be the improvement of schools and academic achievement of all students. While difficult to understand, their primary duty is to not make decisions based on what will get them re-elected or what may benefit constituents with special interests.

District 2 Representative Liz Williams asked about the impact to the district’s Career Technical & Agricultural Education Program’s proposed College & Career Academies. Wilson said that the plan for those would also be significantly impacted and that with “comfortable certainty” he could say that they would have to be placed as a result of necessary cuts.

Williams also asked what individuals who want to change the state’s 14 mill millage rate requirement for school districts could do. Wilson suggested contacting Bulloch County’s state legislative delegation as a starting point to share their concerns with state policy makers.

See more:

- Bulloch Board of Ed to Adopt Increased Millage Rate on Aug 18, Public Hearings Aug 10 & 17

- Bulloch Co Schools: Notice of Property Tax Increase

- Bulloch Board of Ed to Host More Public Hearings, Board Says Decision Honors Community Feedback

Chattooga Sports

Trion Wrestling Hires Randy Steward as New Coach

Chattooga Local Government

Federal Judge Rejects Catoosa GOP’s Motion to Omit Candidates from Ballot

Bulloch Public Safety

04/26/2024 Booking Report for Bulloch County

Bulloch Public Safety

04/09/2024 Booking Report for Bulloch County

Bulloch Public Safety

04/01/2024 Booking Report for Bulloch County

Bulloch Public Safety

04/08/2024 Booking Report for Bulloch County

Bulloch Public Safety

04/22/2024 Booking Report for Bulloch County

Bulloch Public Safety

04/15/2024 Booking Report for Bulloch County