UPDATE:

- Hearings: September 7, 9:00 am and 6:00 pm

- Called Session: September 8, 12:00 pm for scheduled vote

Reminder: The final two hearings about the school district’s 2023 Millage Rate are Thursday, Sept. 7, at 9 a.m. and 6 p.m., in the boardroom of the school district’s Central Office, located at 150 Williams Road in Statesboro.

The hearings are open to the public. Guests may enter the front entrance marked with the letter A. Guests who plan to speak should arrive before the hearings begin, and sign up to speak on the form provided. Each speaker will be given three minutes to speak.

The Board of Education will also host a called session on Friday, September 8, at 12 noon, for a scheduled vote on the 2023 Millage Rate.

A revised millage rate presentation, an updated five-year history of the tax levy, and updated answers to frequently asked questions are available online at www.bullochschools.org/boardpackets. For your convenience any audio visual presentations will be uploaded to the website, and will be displayed within the livestream for your reference.

Watch hearings and meetings live via livestream on our website at www.bullochschools.org/boardlive or Facebook page or later via the archived videos on our website. For all news media inquiries, contact the school district’s Public Relations Department for assistance by email or call 912.212.8512 or 912.536.2827. If you experience technical difficulties during the meeting, email for help or text 912.536.2827.

Original:

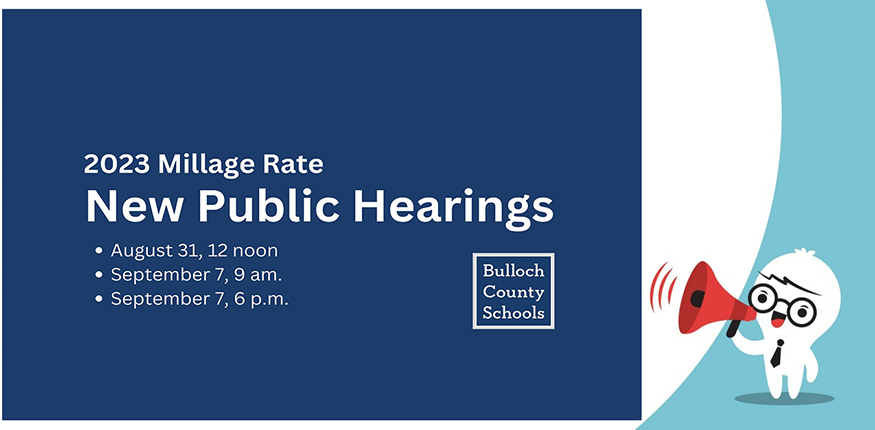

The Bulloch County Board of Education announced that it will host three additional public hearings about the 2023 millage rate.

From Bulloch County Board of Education:

Although the Board of Education followed legal and regulatory protocol for public hearings related to effectively increasing its 2023 millage rate, the Board values the feedback it received about its attendance at public hearings. Therefore, it has delayed its vote and will repeat the public hearing process prior to a final vote on September 8.

All concerned citizens are invited to a second series of public hearings on this tax increase to be held in the boardroom of the Bulloch County Board of Education at 150 Williams Road, Statesboro, Georgia, on the following dates and times:

- Thursday, August 31, 2023 at 12:00 noon

- Thursday, September 7, 2023 at 9:00 a.m.

- Thursday, September 7, 2023 at 6:00 p.m.

A group of individuals attempted to file an emergency injunction to stop the Board’s scheduled vote on the millage rate at its Aug. 18 called session. During Friday’s called session, Superintendent of Schools Charles Wilson recommended an executive session with the Board to make them aware of the legal filing. However, this was not the basis of the Board’s decision to host a second series of public hearings, nor did the Superior Court judge issue the injunction.

The Board originally announced on July 21, its intention to increase the 2023 property taxes it would levy by 16.07 percent over the rollback millage rate of 7.304 mills. It then tentatively adopted a millage rate of 8.478 mills at its July 27 work session, an increase of 1.174 mills over its previous rate of 8.263 mills. This was followed by three public hearings on August 10 and 17.

The proposed tax increase for a home with a fair market value of $225,000 is approximately $103.31 and the proposed tax increase for non-homestead property with a fair market value of $200,000 is approximately $93.92.

The school district’s five-year history of tax levy, the presentation from its original public hearings and answers to frequently asked questions are available on the Bulloch County Schools website at www.bullochschools.org.

Public Notice of Tax Increase

Each year, the Bulloch County Board of Assessors is required to review the assessed value of property tax purposes of taxable property in the county. When the trend of prices on properties that have recently sold in the county indicate there has been an increase in the fair market value of any specific property, the board of assessors is required by law to re-determine the value of such property and adjust the assessment. This is called a reassessment. When the total digest of taxable property is prepared, Georgia law requires a rollback millage rate to be computed that will produce the same total revenue on the current year’s digest that last year’s millage rate would have produced had no reassessments occurred.

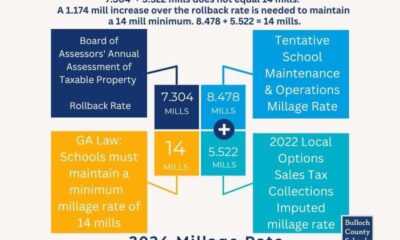

In accordance with Georgia Code 20-2-165, boards of education must maintain an equivalent millage rate of at least 14 mills to prevent a loss of their state equalization grant funding. Currently, Bulloch County Schools’ state equalization grant funding totals more than $7.4 million. Due to the reassessment of property values in Bulloch County, the rollback millage rate required by Georgia law would cause Bulloch County Schools’ equivalent millage rate to fall below 14 mills, thus causing loss of the school district’s equalization funding. Therefore, the Bulloch County Board of Education intends to adopt an equivalent millage that is at least 14 mills and secure the school district’s equalization funding.

The 14-mill calculation requirement is composed of the property tax millage rate that the board must adopt annually along with the equivalent mills produced by the Local Option Sales Tax that the school district collects for maintenance and operations purposes. Based upon the value of the 2023 tax digest, per the Bulloch County Board of Assessors’ reassessment, a complete rollback of the district’s millage rate would be 7.304 mills, which when combined with the imputed value of Local Option Sales Tax collections of 5.522 mills, equates to only 12.826 mills, which is below the legal threshold.

In order to maintain the minimum 14 mills of property tax required under Georgia Code 20-2-165, the superintendent is proposing that the Bulloch County Board of Education adopt a property tax millage rate of 8.478 mills, bringing the total effective millage rate to 14.000 mills. Due to the nature of the millage rate rollback process, this action will effectively constitute an increase in property taxes.

2023TaxDigestand5yrHistoryofLevy-BullochCountyBoardofEducation2023MillageRatePresentation bulloch board of ed

FrequentlyAskedQuestionsonMillageRate bulloch board of ed

Chattooga Sports

Trion’s Garrett Mahan named Positive Athlete

Chattooga Sports

Trion Wrestling Hires Randy Steward as New Coach

Chattooga Local Government

Federal Judge Rejects Catoosa GOP’s Motion to Omit Candidates from Ballot

Bulloch Public Safety

04/26/2024 Booking Report for Bulloch County

Bulloch Public Safety

04/09/2024 Booking Report for Bulloch County

Bulloch Public Safety

04/01/2024 Booking Report for Bulloch County

Bulloch Public Safety

04/08/2024 Booking Report for Bulloch County

Bulloch Public Safety

04/22/2024 Booking Report for Bulloch County

Bulloch Public Safety

04/15/2024 Booking Report for Bulloch County