At its scheduled July 27 work session, the Bulloch County Board of Education tentatively adopted a millage rate which will require an increase in property taxes by 16.07%.

All concerned citizens are invited to the public hearings on this tax increase to be held at the Bulloch County Board of Education at the following dates and times:

- Thursday, August 10, at 12:00 noon;

- Thursday, August 17, at 9:00 a.m.; and

- Thursday, August 17, at 6:00 p.m.

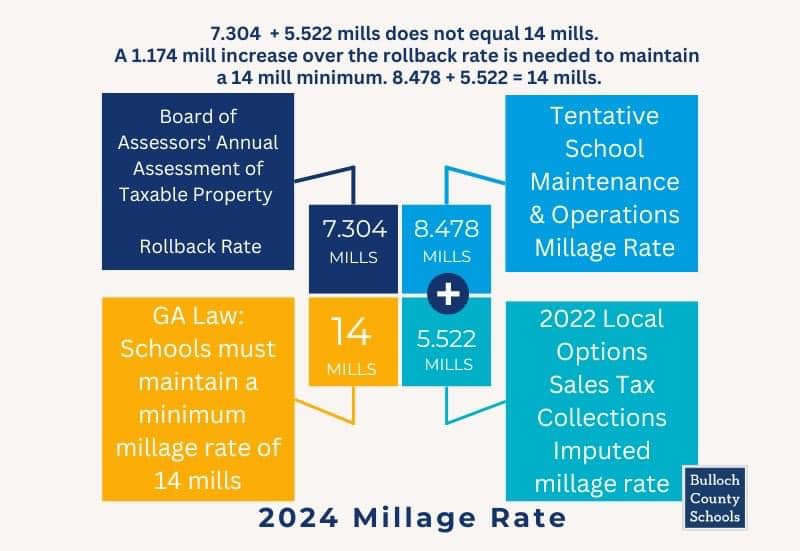

This tentative increase will result in a millage rate of 8.478 mills, an increase of 1.174 mills. Without this tentative tax increase, the millage rate will be no more than 7.304 mills. The proposed tax increase for a home with a fair market value of $225,000 is approximately $103.31 and the proposed tax increase for non-homestead property with a fair market value of $200,000 is approximately $93.92.

Key Documents

Key Points About the Increase

- The purpose of the public hearings will be to explain the purpose of the increase and to hear feedback from the public

- The millage rate is the number of dollars of tax that will be assessed for each $1,000 of property value.

- The proposed rate of 8.478 mills means that $8.478 in tax would be levied on every $1,000 in assessed value. (Example: An average home property value equals $225,000. It’s assessed value (40% of the $225,000) equals $90,000. Subtract $2000 of homestead exemption from the assessed value equals $88,000. Divide by $1000 ($88,000/$1000) equals $88 tax/mill. Multiply $ tax/mill by the millage rate equals $88 multiplied by 8.478 mills. Equals a school tax on property of $746.06.)

- With the exception of last year, the proposed 8.478 mills is lower than all previous year’s millage rates since 2014. The school district has adopted a full roll back of its millage rate 7 of the last 11 years, and a partial roll back last year. A history of the millage rates since 2014 is included in the attached information.

- Georgia law (OCGA 20-2-165) requires school systems to maintain a minimum equivalent millage rate of 14 mills of maintenance & operations property tax or otherwise lose Equalization Funding which is part of the state funding formula for school systems. If Bulloch Count Schools does not maintain the required minimum equivalent millage rate of 14 mills, its future equalization funding of $7.4 million could be at risk.

- In Bulloch County, the school district receives local option sales tax revenue. The 14-mill required millage rate less the imputed Local Option Sales Tax millage rate equals the school district’s maintenance and operations property tax millage rate. The imputed Local Option Sales Tax millage rate is 5.522 mills as determined from 2022 revenues. 14 mills less 5.522 mills = 8.478 mills. 8.478 mills is higher than the prior year’s 8.263 mills and, thus, represents an increased millage rate.

- The proposed millage rate of 8.478, which is a 1.174 mill increase over the rollback rate (7.304 mills), will increase school maintenance and operations property taxes on a homestead property with a fair market value of $225,000 by approximately $103.31 and on a non-homestead property with a fair market value of $200,000 by approximately $93.92.

Bulloch County Schools

Chattooga Opinions

The Joy of the Journey: Under God

Chattooga Sports

Trion’s Garrett Mahan named Positive Athlete

Chattooga Sports

Trion Wrestling Hires Randy Steward as New Coach

Chattooga Local Government

Federal Judge Rejects Catoosa GOP’s Motion to Omit Candidates from Ballot

Bulloch Public Safety

04/26/2024 Booking Report for Bulloch County

Bulloch Public Safety

04/09/2024 Booking Report for Bulloch County

Bulloch Public Safety

04/01/2024 Booking Report for Bulloch County

Bulloch Public Safety

04/08/2024 Booking Report for Bulloch County

Bulloch Public Safety

04/22/2024 Booking Report for Bulloch County

Bulloch Public Safety

04/15/2024 Booking Report for Bulloch County