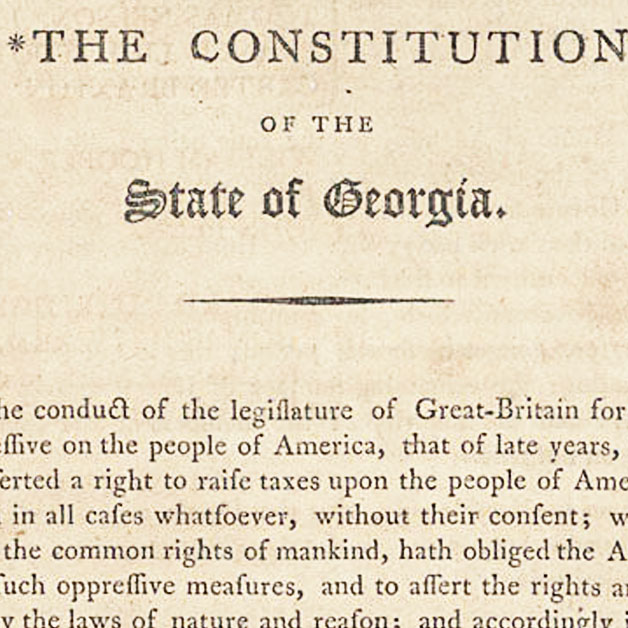

Georgia voters overwhelmingly passed FIVE Constitutional Amendment changes to the state Constitution on Tuesday.

Amendment 1 — Portion of Revenue from Outdoor Recreation Equipment Sales Tax Dedicated to Land Conservation Fund Amendment

This gives the state the authority to dedicate “up to” 80% of the existing sales and use tax on outdoor sporting goods to be used for land conservation. This was initially supposed to happen when the sales tax was put into place, but never occurred. The “up to” 80% language means the legislature is still not required to allocate the tax money but can allocated up to that percentage.

The funds would be used to support state parks and trails, provide stewardship of conservation lands, and acquire land for the provision or protection of clean water, wildlife, hunting, fishing, military installation buffering, or outdoor recreation.These initiatives would be carried out by creating the Georgia Outdoor Stewardship Trust Fund, which would be handled by the state. 40% of the 80% allocated would go to this fund.

Amendment 2 – Business Court Creation

Amendment 2 created a new court system in the state of Georgia, specifically for businesses. This will allow judges in the business court to be appointed by the Governor with no limit on how long a judge can serve.

Amendment 3 – Forest Land and Timberland Conservation

This amendment revises current law by subclassifying forest land conservation use property for ad valorem taxation purposes. It would change the method for establishing the value of forest land conservation use property and related assistance grants.

Amendment 4 – Marsy’s Law/Victim’s Rights

Amendment 4, known as Marsy’s Law, addresses rights of victims of crime. It is part of a national effort by a California billionaire who seeks to provide more rights to crime victims than anyone else in the legal system. This was the most contentious amendment on the ballot

Amendment 5 – School Sales Tax Referendums

Amendment 5 is the School Sales Tax Referendums Amendment. This amendment will allow school districts or groups of school districts within a county to call for a sales and use tax referendum for taxpayers.

Jessica Szilagyi is a former Statewide Contributor for AllOnGeorgia.com.

Chattooga Local News

Legislation Introduced to Combat Chronic Absenteeism in Georgia Public Schools

Chattooga Local News

Pastor Jason Boyd Named Pastor of West Berryton Faith Temple Holiness Church

Chattooga Local Government

Democrats Announce Qualifying Dates for Chattooga Board of Education Races

Bulloch Public Safety

02/23/2026 Booking Report for Bulloch County

Bulloch Public Safety

01/26/2026 Booking Report for Bulloch County

Bulloch Public Safety

02/09/2026 Booking Report for Bulloch County

Bulloch Public Safety

02/16/2026 Booking Report for Bulloch County

Bulloch Public Safety

02/20/2026 Booking Report for Bulloch County

Bulloch Public Safety

02/17/2026 Booking Report for Bulloch County