The following article is an opinion piece and reflects the views of only the author and not those of AllOnGeorgia.

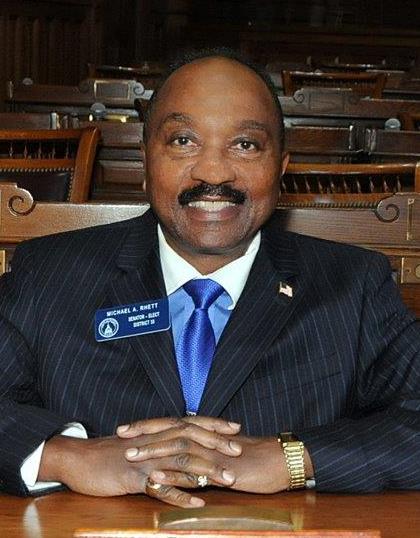

By: Senator Doc Rhett of Cobb County. Senator Rhett is a member of the Senate Finance, Higher Education, Judiciary, and Veterans, Military, and Homeland Security Committees. Senator Rhett is a retired Master Sergeant in the United States Air Force. He managed personnel, prepared young individuals for leadership and worked as a training instructor for the 700th Airlift Squadron. In his civilian life, Senator Rhett was a Vocational, Educational and Instructional Coordinator at Jefferson Place and City of Refuge.

Last month the Georgia General Assembly held rare joint budget hearings to address proposed spending cuts by Governor Brian Kemp. Over that same time, we have read many stories in the media about how these cuts could lead to job losses and reduce government services. Before Georgia furloughs state employees or eliminates government services, I believe we have a duty to make sure we are collecting all revenue that is due.

The Faith Truth and Justice Project estimates that Georgia could be losing as much as $750 million in revenue because some e-commerce retailers, known as “marketplace facilitators” are using a loophole in Georgia law that allows them to forgo the collection of online sales tax. Marketplace facilitators are large, sophisticated e-commerce retailers, like Walmart.com and Etsy, that advertise and facilitate the transaction of products from third parties on their website. For example, it is estimated that 90% of Walmart.com e-commerce sales are third party sales.

Untaxed e-commerce sales on Walmart.com alone are estimated to be costing Georgia and local governments up to $82 million a year. In 2019, Walmart remittances are estimated to be less than $10 million in sales tax on more than $1.2 billion in online sales in Georgia. Thats a lot of revenue that could be used to offset potential state budget cuts.

Closing the sales tax loophole is also an important policy goal for local governments. Georgia uses a variety of Special Purpose Local Option Sales Taxes, or SPLOSTs to fund everything from education to transportation. When sales taxes are eroded by loopholes like marketplace facilitators, local governments also receive less money. To fill the revenue gap caused by falling SPLOST money, cities and counties are be forced to raise property taxes.

If Georgia wants to remain competitive with states like Texas, Florida and Tennessee we need to keep our income tax and property tax burdens in check. We cannot do this if we are allowing e-commerce sales taxes to erode at the same time. That is why I support Representative Brett Harrell’s legislation to close the marketplace facilitator loophole in Georgia. And I encourage Governor Kemp to consider Representative Harrell’s bill before making any deep cuts to government services in Georgia. As this process moves forward I welcome input from my constituents and others.

2 Comments

Leave a Reply

Cancel reply

Leave a Reply

Chattooga Opinions

Medically Supervised Weight Loss: Inside Premier Weight Loss & Medispa

Chattooga Local News

Georgia Power Files Plan for Customer Rate Decrease with Public Service Commission

Chattooga Local Government

Carr Pushes for Permanent Halt of Medicare and Medicaid Funding for Child Sex-Change Procedures

Bulloch Public Safety

02/20/2026 Booking Report for Bulloch County

Bulloch Public Safety

01/26/2026 Booking Report for Bulloch County

Bulloch Public Safety

02/09/2026 Booking Report for Bulloch County

Bulloch Public Safety

02/16/2026 Booking Report for Bulloch County

Bulloch Public Safety

02/02/2026 Booking Report for Bulloch County

Bulloch Public Safety

01/30/2026 Booking Report for Bulloch County

Patricia Wisdom

November 27, 2019 at 2:07 pm

Senator Rhett,

You have my full support in pushing forward with Representative Harrell’s legislation to close the market place facilitator loophole in Georgia in order to offset deep cuts in government services. Approval of this legislation would bring significant revenue to the State and its counties and cities. I hope that you will be able to get the support that is needed in Congress. I will further share with our Council and Mayor and constituents. Thank you so much for your service.

Robert Steinbach

December 11, 2019 at 7:38 pm

To the Most Honorable Senator Doc Rhett,

I most wholeheartedly support your pushing forward with the Most Honorable Representative Brett Harrell’s legislation to close the market place facilitator state sales tax legal loophole. The state has a duty and responsibility to collect all of the revenue rightfully owed the state and local governments to prevent unnecessary interruption of necessary state and local services and to prevent unnecessary furloughs and delays of much needed projects. I hope you will get the support you need in the 2020 legislature session.