The Rural Hospital Tax Credit Program is set to enter its fourth year of availability, but many people still don’t know which hospitals they can donate or how to turn the donation into a tax credit.

In 2016, the Georgia General Assembly passed Senate Bill 258 which awards Georgia income tax credits to individual and corporate taxpayers who contribute to qualified rural hospital organizations located in Georgia.The Rural Hospital Tax Credit Program became effective in Georgia beginning January 1, 2017 and annually directs up to $60 million to rural facilities. During the first six months of each year, a qualified RHO may accept up to $2 million of corporate contributions and $2 million of individual contributions.

From January 1 through June 30 of each taxable year:

- a single individual or a head of household may receive a 100% Georgia income tax credit for contributions to RHOs, up to a limit of $5,000;

- a married couple filing a joint return may receive a 100% Georgia income tax credit for contributions to RHOs, up to a limit of $10,000; and

- an individual who is a member of a limited liability company, shareholder of an “S” Corporation, or partner in a partnership (pass-through entities) is allowed a 100% Georgia income tax credit for up to $10,000 of the amount they contribute to a RHO, so long as they would have paid Georgia income tax in that amount on their share of taxable income from the pass-through entity.

A hospital may use donated funds to finance the construction of a new treatment center that will provide healthcare services, for administrative costs, to finance improvements to existing facilities, to pay a fundraising consultant, and to pay down short-term and long-term debt.

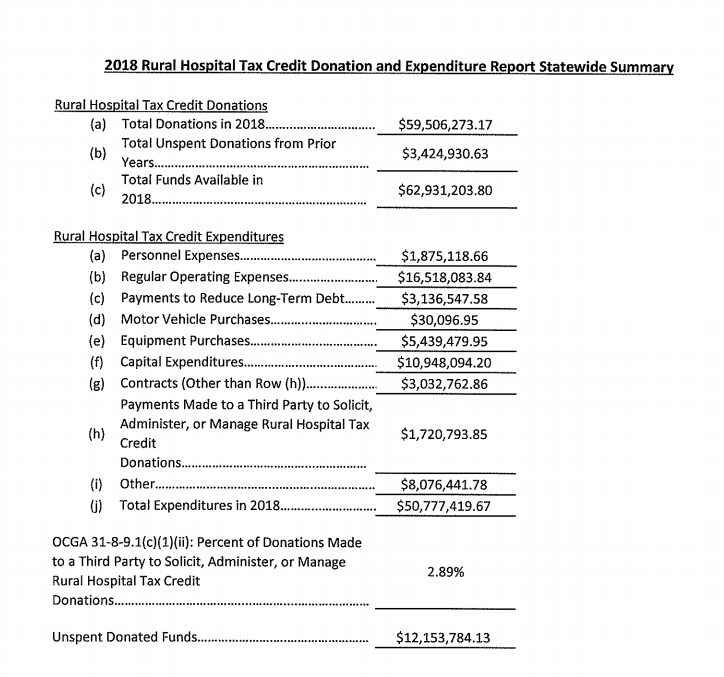

Hospitals are required to file a Rural Hospital Tax Credit Expenditure and Donation Report with the Georgia Department of Community Affairs on an annual basis. In calendar year 2018, just over $59,506,000 went to rural hospitals through the donation program of which hospitals expended a little more than $50,777,000.

The credit recently came under fire after a report released by the Georgia Department of Audits & Accounts found that the program “does not ensure that the neediest hospitals receive the most money and will likely experience a decline in funding,” the Associated Press said this week. You can read more on that here.

Here’s an overview from 2018:

Financial information for 2019 is not yet available, but the eligibility list for calendar year 2020 has been released by the Georgia Department of Community Affairs.

The Rural Hospital Organizations listed below have been determined to be eligible for the Rural Hospital Tax Credit Program for Calendar Year 2020 based on current information. Story continues below.

2020_Eligible_HospitalsYou can see the eligible hospitals ranked by financial need in the PDF document below:

2020_Eligible_Hospitals_Ranked_by_Financial_NeedJessica Szilagyi is a former Statewide Contributor for AllOnGeorgia.com.

Chattooga Local News

Pastor Jason Boyd Named Pastor of West Berryton Faith Temple Holiness Church

Chattooga Local Government

Democrats Announce Qualifying Dates for Chattooga Board of Education Races

Bulloch Public Safety

02/23/2026 Booking Report for Bulloch County

Chattooga Local News

Postal Service Celebrates Bruce Lee

Bulloch Public Safety

01/26/2026 Booking Report for Bulloch County

Bulloch Public Safety

02/09/2026 Booking Report for Bulloch County

Bulloch Public Safety

02/16/2026 Booking Report for Bulloch County

Bulloch Public Safety

02/20/2026 Booking Report for Bulloch County

Bulloch Public Safety

02/17/2026 Booking Report for Bulloch County