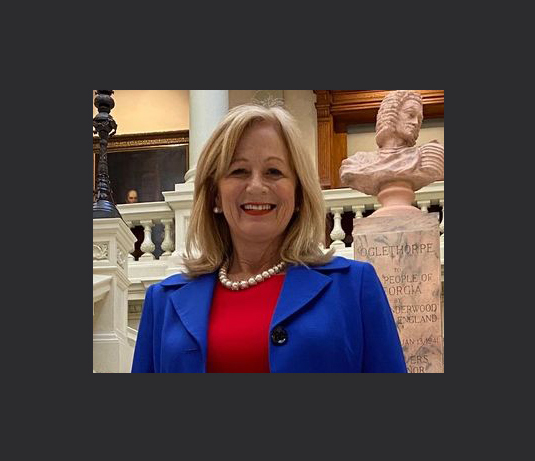

Candidate for Lt Governor of Georgia, Jeanne Seaver, is saying she is on board with abolishing the State Income Tax and returning the funds to Georgians. She details how she would do that and explains how she thinks it would work for Georgia. See the video and email below.

Dear Georgians:

There has been talk about abolishing the Georgia State Income and our campaign has been talking about this since our campaign got in the race in February of 2021. Now we have candidates that are sitting legislators that now have picked up this talking point but have no solution to offer and have been legislators for close to 10 years and have done nothing.

Article published by James Salzer in the AJC

Click here to read articleBelow is a video of me talking about the solution on how to accomplish this!

Click here to view videoWe wanted to include Facts below on why this concept makes sense!

GA end of the fiscal year in 2021

GA – 3.7 Billion in surplus

Georgia’s rainy day fund grew from $2.7 billion on July 1, 2020, to nearly $4.3 billion by June 30, 2021, because of the surplus State law requires 15% of the state’s general revenue funds be placed in the reserve account.

Lawmakers must decide what the state will do with the remaining nearly $2.2 billion.

TN – 156.4 Million in Surplus – No state income tax

Texas – Forecasts by 2023 that will have a 7.85 Billion Surplus – No State Income Tax

Time for all to pay their fair share and abolish the State Income Tax and return the funds to Georgians!

Learn more about surplus in the link below.

https://sao.georgia.gov/

statewide-reporting/georgia- revenues-and-reserves Replace with the Georgia Fair Tax Act (GA -HB 543)

Replacing our state income tax with a consumption tax on both goods and services will make Georgia unique in attracting employers. Key competitors like Florida, Texas and Tennessee have no state personal income tax, but ours will have no corporate income tax. Plus, a new consumption tax will only be a small increase in today’s sales tax, as we include services as well as goods.

A a successful state Fair Tax can be a model for potentially implementing a national FAIR Tax that will make the U.S. the envy of the world in job creation.

A BILL to be entitled an Act to amend Title 48 of the Official Code of Georgia Annotated, relating to revenue and taxation, so as to repeal income taxes in their entirety; to completely revise sales and use taxes; to repeal the corporate net worth tax; to provide for conditions and limitations; to provide for legislative findings; to provide definitions; to provide a short title; to provide for related matters; to provide an effective date; to repeal conflicting laws; and for other purposes.

More details to review:

https://trackbill.com/bill/

georgia-house-bill-543- georgia-fairtax-act-enact/ 1420541/ Thank you for listening and please feel free to reach out for any additional questions.

Sincerely yours,

Jeanne Seaver

Chattooga Schools

Berry Professor Publishes Original Short Story Collection

Chattooga Public Safety

Most Recent Chattooga County Food Service Inspections

Chattooga Schools

GNTC names 2026 GOAL, Rick Perkins Award winners

Chattooga Local News

When Summerville Needed Him, Kevin Godfrey Showed Up — Again

Bulloch Public Safety

01/20/2026 Booking Report for Bulloch County

Bulloch Public Safety

01/12/2026 Booking Report for Bulloch County

Bulloch Public Safety

01/09/2026 Booking Report for Bulloch County

Bulloch Public Safety

01/05/2026 Booking Report for Bulloch County

Bulloch Public Safety

01/26/2026 Booking Report for Bulloch County