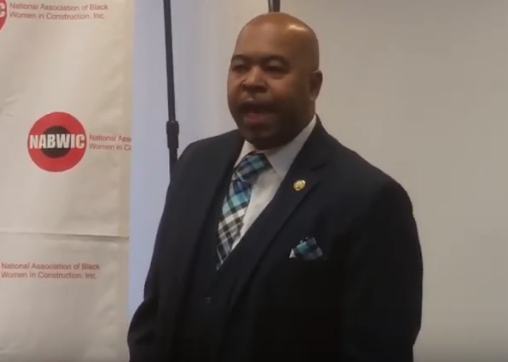

Larry Scott has been sentenced to federal prison for failing to disclose to the City of Atlanta that while he served as the Director of Contract Compliance, he also secretly worked as the business manager for consulting firm that was hired by businesses who wanted construction contracts in the Atlanta-metropolitan area.

“Scott’s conviction and sentence close yet another chapter in the disappointing saga of corruption within the City of Atlanta government,” said U.S. Attorney Byung J. “BJay” Pak. “Based on his executive-level positions, Scott was trusted to serve the citizens of Atlanta. By failing to disclose his own business interests, however, Scott betrayed the program he was charged to protect – and, as a result, tarnished the integrity of Atlanta’s disadvantaged business program.”

“This sentencing is a warning to any public official who would contemplate abusing their power for personal gain,” said Chris Hacker, Special Agent in Charge of FBI Atlanta. “Anyone who tries to take advantage of a trusted position by illegally profiting from it will be pursued. The FBI will continue its efforts to end public corruption in Atlanta and anywhere in the state of Georgia.”

“The law is clear on the issue of taxable income and who is required to file and pay taxes: there is no gray area on the subject and we hope today’s sentencing sends a message that intentionally filing a false tax return is a prosecutable crime regardless of your position,” said Thomas Holloman, IRS Criminal Investigations, Special Agent in Charge, Atlanta Field Office. “We should not forget that the ultimate victims in this case are the people of Atlanta– those honest taxpayers who diligently file correct tax returns each year and pay their fair share of tax.”

According to U.S. Attorney Pak, the charges and other information presented in court: the City of Atlanta – Mayor’s Office of Contract Compliance, advertises that they strive “to mitigate the effects of past and present discrimination against women and minority businesses, [and] to promote full and equal business opportunity for all persons doing business with the City of Atlanta” by “linking small, minority, female and disadvantaged businesses with City of Atlanta, business opportunities.”

From 2002 to 2019, Scott held several positions with the City of Atlanta, including, serving as the: (a) Senior Contract Compliance Manager in the Office of Contract Compliance; (b) Director of Procurement in the Department of Watershed Management, and (c) the Director of the Office of Contract Compliance. In those positions, Scott earned between $57,000 and $98,000 per year. In total, from 2012 to 2017, Scott earned approximately $530,000 as an employee with the City of Atlanta.

On February 23, 2011, Scott incorporated Cornerstone U.S. Management Group, LLC (“Cornerstone”) with the Georgia Secretary of State as a for-profit corporation. Cornerstone is a consulting firm for businesses seeking construction contracts in the Atlanta-metropolitan area and elsewhere. In its Articles of Organization, Cornerstone listed Scott as its organizer and registered agent. From 2012 until November 2017, Scott served as Cornerstone’s business manager. In that role and during that six-year period, Cornerstone paid Scott between approximately $1,000 and $5,000 per month. In total, from 2012 to 2017, Scott earned approximately $220,000 as Cornerstone’s business manager.

According to the City of Atlanta’s Code of Ethics, certain City of Atlanta officials and employees must disclose all “positions of employment held by the official or employee in any business … for all or any portion of the year, including a description of the type of business and the existence and nature of any business done by the employer entity with the city.” The City of Atlanta’s Code of Ethics further requires that these officials and employees disclose, “[e]ach and every source of income from any business received by such official or employee in excess of $5,000 derived from any single source in the preceding calendar year.”

As the City of Atlanta’s Senior Contract Compliance Manager, Director of Procurement, and Director of Contract Compliance, the City of Atlanta required Scott to complete annually a Financial Disclosure Statement listing any outside employment and sources of income of more than $5,000 per year for calendar years 2012 to 2017.

From 2012 to 2017, Scott electronically filed six false Financial Disclosure Statements, each executed under penalty of perjury. On each Financial Disclosure Statement, Scott knowingly failed to disclose that he had been employed by Cornerstone and that he had received more than $5,000 in annual income from Cornerstone.

From 2012 to 2017, Scott earned approximately $220,000 from Cornerstone while serving as a full-time management or executive level employee with the City of Atlanta. Scott never disclosed to the City of Atlanta his employment with and income from Cornerstone. Scott knew that if he had disclosed his income from Cornerstone on his annual Financial Disclosure Statements, the City of Atlanta could have terminated Scott.

From 2012 to 2017, Scott also filed six false and fraudulent federal income tax returns – in that Scott failed to report the majority of the income that he earned from Cornerstone on his tax returns. For example, in 2015, Scott earned approximately $156,036 in income – (a) $99,136 as the City of Atlanta’s Director of Contract Compliance; and (b) $56,900 as Cornerstone’s business manager. Yet, on his 2015 federal income tax return, Scott falsely listed his “total income” as only $101,630.

On September 4, 2019, Larry Scott, 55, of Atlanta, pleaded guilty to a criminal information charging him with one count each of wire and tax fraud. Based on those convictions, Scott was sentenced to two years in prison to be followed by three years of supervised release and was ordered to pay approximately $125,000 in restitution.

The FBI and IRS Criminal Investigation investigated this case.

Assistant U.S. Attorneys Jeffrey W. Davis, Chief of the Public Integrity and Special Matters Section, Stephen H. McClain, Chief of the Complex Frauds Section, and Sekret Sneed prosecuted the case.

Chattooga Schools

Berry Professor Publishes Original Short Story Collection

Chattooga Public Safety

Most Recent Chattooga County Food Service Inspections

Chattooga Schools

GNTC names 2026 GOAL, Rick Perkins Award winners

Chattooga Local News

When Summerville Needed Him, Kevin Godfrey Showed Up — Again

Bulloch Public Safety

01/20/2026 Booking Report for Bulloch County

Bulloch Public Safety

01/12/2026 Booking Report for Bulloch County

Bulloch Public Safety

01/09/2026 Booking Report for Bulloch County

Bulloch Public Safety

01/26/2026 Booking Report for Bulloch County

Bulloch Public Safety

01/05/2026 Booking Report for Bulloch County