Applications for Georgia’s Teacher Recruitment Tax Credit, which was created to improve teacher recruitment for rural and low-performing public schools, are now available.

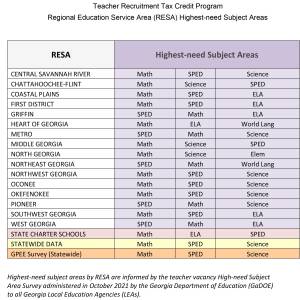

Eligible teachers are those recently hired to teach in a high-need subject area at one of 100 Participating Schools. High-need subject areas are defined regionally by the state’s Regional Education Service Agencies (RESAs). Teachers selected to participate in the Teacher Tax Credit program will receive a $3,000 credit on their state income taxes each year, for five consecutive school years.

The Teacher Recruitment Tax Credit was established by the passage of House Bill 32 in the 2021 legislative session, sponsored by Representative Dave Belton.

“Georgia teachers have an impressive record of recent academic success, as evidenced by our record graduation rate and K-12 scores,” Representative Belton said. “This program places a laser focus on our rural schools and those performing in the lowest 5 percent. More importantly, it works to restore the all-important profession of teaching.”

Teacher recruitment and retention are top priorities for the state and the Georgia Department of Education. In addition to the implementation this year of the tax credit, State School Superintendent Richard Woods is advocating during the current legislative session for full funding of a pay raise for teachers, the removal of the threat of certification loss as a punishment for new teachers identified as “Needs Development” through the teacher evaluation system, the establishment of a pilot to design an evaluation system built on professional progression with embedded supports for educators, and changes to allow districts to utilize retired educators full time to fill high-need teaching positions.

“If we want our students to achieve, it is absolutely essential that we retain our hard-working educators,” Superintendent Woods said. “That means creating an environment where those educators can thrive, compensating them appropriately, and treating them as the competent professionals they are. I appreciate Rep. Belton and the Georgia General Assembly making this tax credit program a reality for teachers who answer the call to teach in rural Georgia and in underperforming schools.”

Background Information on Teacher Recruitment Tax Credit

The legislation passed in 2021 requires the Georgia Department of Education to first identify all Qualifying Public Schools in the state – defined in law as any school located in a rural territory and/or performing in the lowest 5 percent of schools in the state. GaDOE published the full list of Qualifying Public Schools on its website in October.

The agency is then required to narrow the list to 100 Participating Schools. This list was published, along with the criteria used to develop it, on GaDOE’s website in December.

See the application and other background information on the GaDOE’s website HERE.

1 Comment

Leave a Reply

Cancel reply

Leave a Reply

Chattooga Local News

Two Found Deceased Across from Chattooga High School; Investigation Underway

Bulloch Public Safety

7/23/2025 Booking Report for Bulloch County

Chattooga Local News

Chattooga Curtain Call to present Shrek Jr.

Chattooga Public Safety

Leader of Multi-State Fentanyl and Methamphetamine Trafficking Ring Sentenced to Federal Prison

Bulloch Public Safety

06/30/2025 Booking Report for Bulloch County

Bulloch Public Safety

7/14/2025 Booking Report for Bulloch County

Bulloch Public Safety

7/21/2025 Booking Report for Bulloch County

Bulloch Public Safety

7/18/2025 Booking Report for Bulloch County

Bulloch Public Safety

7/11/2025 Booking Report for Bulloch County

Juan

March 23, 2022 at 6:19 pm

Teachers should be running from Georgia. Kemp passed Bills on CRT, also allowing parents to have input in what they want their children taught. Here’s a hint teach your idiot at home. Also Kemp, has repeatedly passed laws against children wearing masks in school. I can’t see any teacher willing to sacrifice their lives to teach in a Red State.