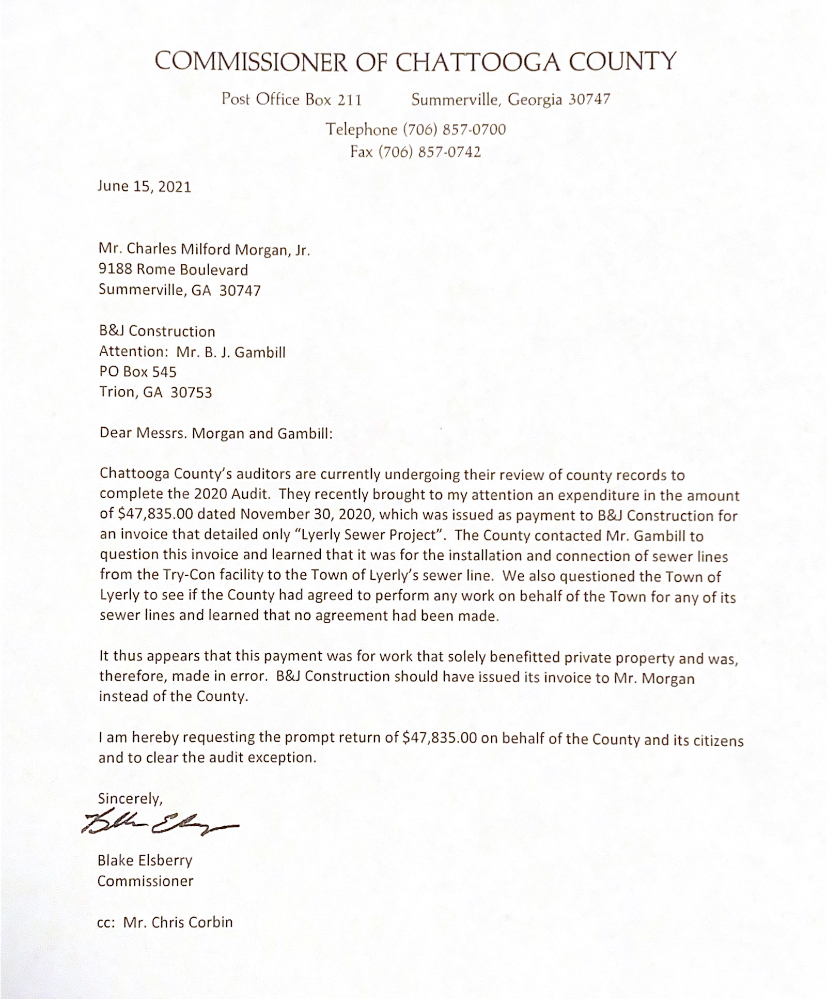

Chattooga County Sole Commissioner Blake Elsberry said “at the end of the (state) audit there is a comment for a possible violation for the Gratuities Clause from the state of Georgia. It is based on an invoice that was found for 47,000 dollars and some change for a sewer project.”

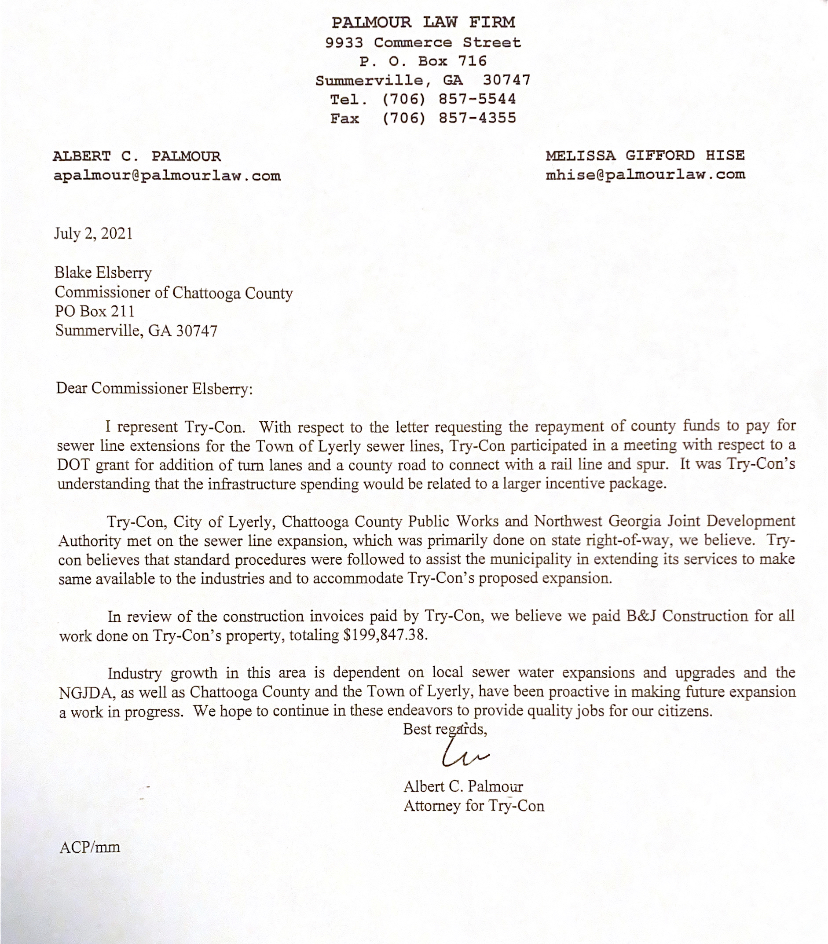

“There is a possibility some of the work may have been done on private property,” according to Elsberry. The work was completed at Try-Con in Lyerly and the funds came out of the county SPLOST account.

What is SPLOST used for?

A special-purpose local-option sales tax (SPLOST) is an optional 1% sales tax levied by any county for the purpose of funding the building of parks, schools, roads, and other public facilities. Elsberry did say SPLOST money could be used for sewers on public property.

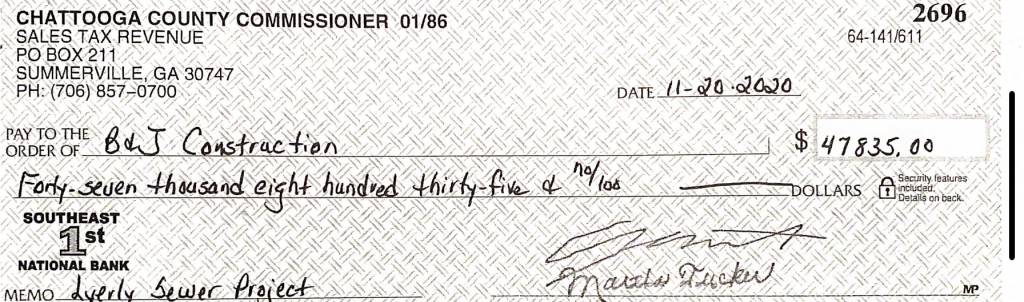

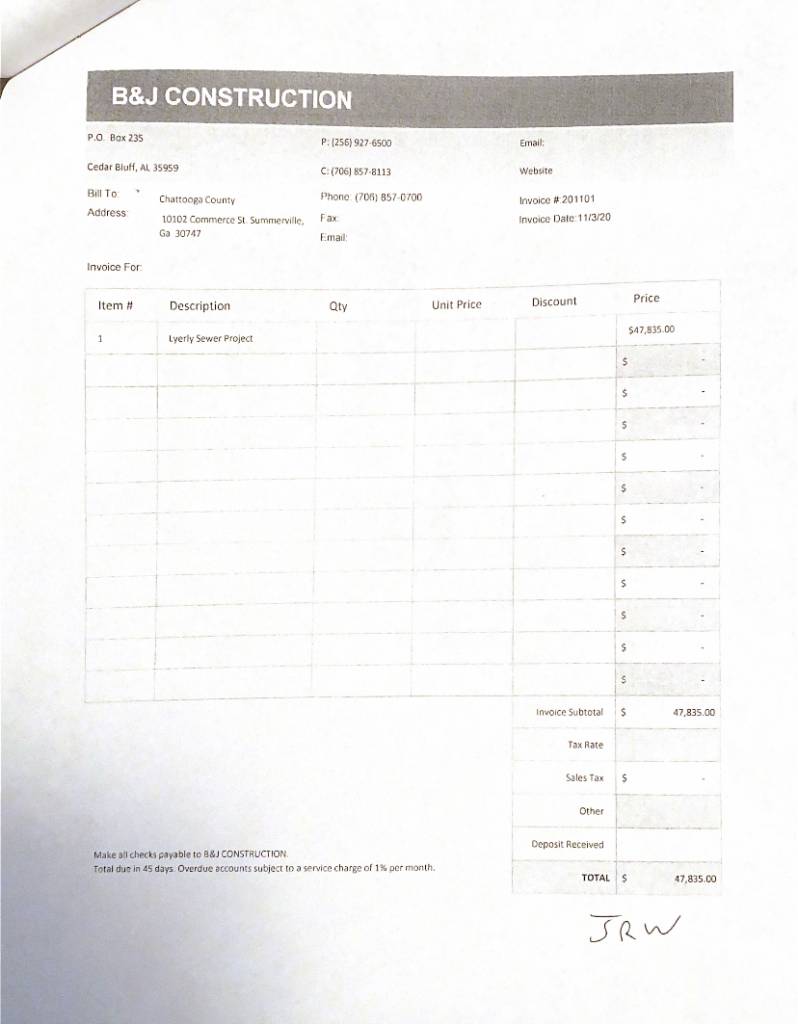

The check for $47,835.00 was paid to B&J Construction on November 20, 2020.

Commissioner Elsberry provided the correspondence thus far and said he is still investigating the matter to determine if the work was done on private property. “What we cannot do is work like that on private property,” Elsberry said.

What is the Gratuities Clause?

The Gratuities Clause is a section in the Georgia Constitution (See Article III, Section VI, Paragraph VI) which prohibits the General Assembly from using tax dollars or state property to donate, offer a gratuity, or forgive a debt or other obligation of a private entity or individual.

In more recent years, the courts, including the Georgia Supreme Court, have ruled that the clause extends to local governments, and that the Gratuities Clause, through court opinions, had even been extended down to hospital authorities, development authorities, school boards, and local pension boards. This is a well-known prohibition and is outlined on the Georgia Association of County Commissioners of Georgia website.

2020 Chattooga County Audit

2020 Chattooga County Financial Statements (1)