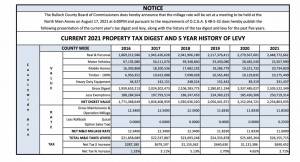

The Bulloch County Board of Commissioners has given notice of an increase in property taxes.

The Bulloch County Board of Commissioners has tentatively adopted a millage rate, which will require an increase in property taxes by 2.02% percent.

Public hearings on this tax increase will be held at the Bulloch County North Main Annex, 115 North Main Street, Statesboro, on August 17, 2021 at 6:00 PM; and August 19, 2014 at 8:30 AM. One was also held on August 10 at 6 pm.

This tentative increase will result in a millage rate of 11.60, a decrease of 0.233 mills. Without this tentative tax increase, the millage rate will be no more than 11.37 mills.

The proposed tax increase for a home with a fair market value of $150,000 is approximately $13.62, and the proposed tax increase for a non-homestead property with a fair market value of $150,000 is approximately $13.80. The proposed tax increase for a home with a fair market value of $200,000 is approximately $18.22, and the proposed tax increase for a non-homestead property with a fair market value of $200,000 is approximately $18.40.

EXPLANATION OF NOTICE OF PROPERTY TAX INCREASE

After preparing the annual digest, if the County estimates it will collect more in property taxes than the year before because of increased assessment values, there is an option to either roll back the millage rate or leave it unchanged.

The Taxpayer Bill of Rights (TABOR) law, adopted by the Georgia General Assembly in 1999, distinguishes inflationary from real assessment growth while preparing the tax digest. The TABOR law intended to prevent “backdoor” tax increases resulting from inflated assessment growth in the tax digest versus gains resulting from physical development generated from the addition of new or improved properties. The circumstances that have caused this particular notice are not the kind of “backdoor” or indirect tax increase that the TABOR law initially contemplated.

The inflationary growth in reassessed properties that occurred during the past year is caused by three factors: 1) from properties such as apartments, offices, and stores assessed according to net income earned in proportion to their property values, which has grown faster than the inflation rate – a frequent occurrence in a recovering economy; 2) from increased sales prices from housing transactions; and, 3) from distressed properties which are sold and assessed at the discounted sales price for the first year, and then reassessed at fair market value after that, by a mechanism of a state law passed in 2010. The additional ad valorem property tax generated represents approximately two percent (2.02%) in revenue growth. This level of increase is at or below past and current measures of inflation.

According to state law, for Bulloch County to legally claim it isn’t raising taxes for 2021, it would have to reduce the current millage rate of 11.833 mills to a rollback rate of 11.37 mills. Bulloch County will reduce the current general millage rate from 11.833 mills to 11.60 mills. State law requires the tax increase notice to state that the 11.60 millage rate would cost an additional $13.80 for taxpayers whose home was worth $150,000 in 2021, depending on their use of a homestead exemption. It is more accurate to state that the millage rollback would save homeowners these amounts rather than if the current millage rate stayed the same.

A millage rate of 11.60 is needed to meet specific goals that include addressing the ongoing impact and costs of the COVID-19 pandemic that federal stimulus funds do not cover. More importantly, the Fiscal Year 2022 budget proposal provides additional resources urgently needed for law enforcement and the County jail, judicial support, and restoring other services to full recovery.

The County would compromise its current long-term financial plan and service demands with the loss of revenue generated by a millage rollback. The County’s finances and service demands differ from private business. In addition to providing a good product and service, private enterprise relies on profit and loss and returns on investment, including shareholder dividends. Bulloch County is governed by working within its means and by setting a reasonable rate of taxation to provide services to protect and enhance the health, safety, and welfare of the entire community, as expressed by its citizens, along with mandated requirements dictated from higher levels of government. The County cannot resort to using reserves to fund operations at the risks of lowering the County’s credit ratings, affecting cash flows, and having sufficient emergency funds. In the event of natural or manmade disasters.

Bulloch County’s population growth will continue. Therefore, the need to address service demands at an appropriate level, now and in the future, is an ongoing challenge. The costs for law enforcement, court, and social services, infrastructure maintenance, and solid waste management have risen disproportionately to the amount of property tax and other revenues generated. Increases in criminal activity, emergency medical incidents, traffic congestion, and other factors have placed demands on the County to adequately staff and equip additional personnel and upgrade and maintain capital resources.

As they always have, the Board of Commissioners must meet the ongoing challenges for balancing competing and increasing demands for services into cost outputs and correctly measuring and generating the inputs needed from taxes and other revenues. In adopting the Fiscal Year 2022 budget, the Board of Commissioners has considered the County Manager’s fiduciary recommendation to provide a partial rollback of the millage rate, providing a form of tax relief or avoidance.

As such, the County will welcome the opportunity to discuss this issue through the advertised hearings and other available means.

Chattooga Opinions

Medically Supervised Weight Loss: Inside Premier Weight Loss & Medispa

Chattooga Local News

Georgia Power Files Plan for Customer Rate Decrease with Public Service Commission

Chattooga Local Government

Carr Pushes for Permanent Halt of Medicare and Medicaid Funding for Child Sex-Change Procedures

Bulloch Public Safety

02/20/2026 Booking Report for Bulloch County

Bulloch Public Safety

01/26/2026 Booking Report for Bulloch County

Bulloch Public Safety

02/09/2026 Booking Report for Bulloch County

Bulloch Public Safety

01/22/2026 Booking Report for Bulloch County

Bulloch Public Safety

02/16/2026 Booking Report for Bulloch County

Bulloch Public Safety

02/02/2026 Booking Report for Bulloch County