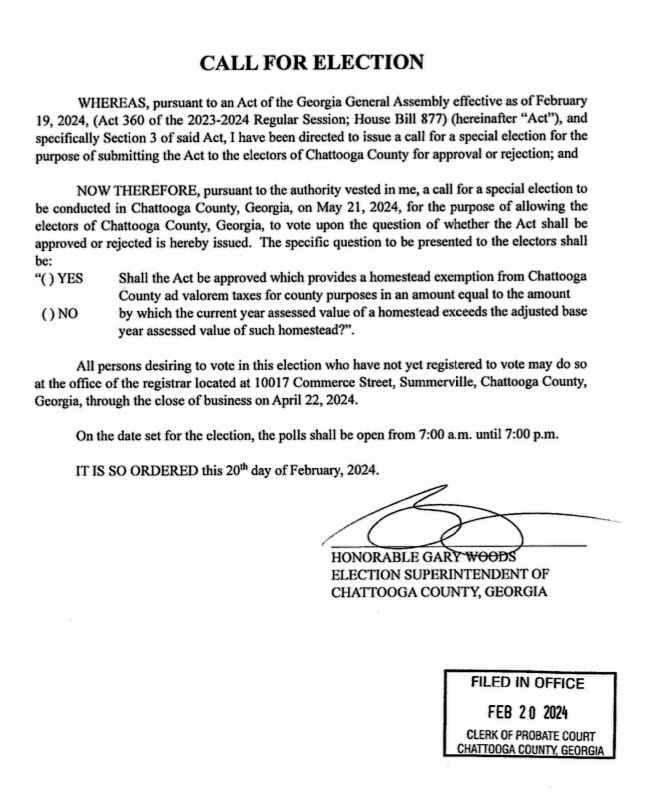

AllOnGeorgia recently reached out to John Bailey, a member of the Chattooga County Board of Tax Assessors, seeking information and insights on the Local Homestead Exemption Freeze legislation set to appear on the May 21st ballot.

Below is his response:

In response to your request for my opinion on the Local Homestead Exemption Freeze legislation that will appear on the May 21st ballot, I will be happy to comply after making a full disclosure on my circumstances. First, I am currently a member of the Chattooga County Board of Tax Assessors. The board has neither developed nor adopted a board position on this subject and most likely will not. Any opinions or other information that I may provide on the legislation are solely my own as a private citizen. Second, as a home owner in Chattooga County, who has no intention of selling or modifying my home during my lifetime, the legislation, as I understand it, would freeze my taxable homestead assessment for the remainder of my life. Third, I have not actually read the legislation and my comments are based entirely on my understanding of what it contains.

As I alluded above, the legislation will purportedly freeze the assessed value of a person’s homestead property for tax purposes until such time as that property is sold or in any other way disposed of, modifications are made to the home or accessories, or the home owner is deceased. At such time the freeze would be broken and the property would be reassessed for tax purposes at the then current Fair Market Value. It is important, however, to understand that freezing the taxable value does not guarantee that taxes will not go up. Our taxes are based on the millage rates that are developed each year by the Sole Commissioner and the School Board. These millage rates will be based on the Tax Digest and the amount of revenue each entity needs to run its operation.

This legislation is something that I like to refer to as a “political solution” to a problem, not a real fix. Members of the Georgia Senate acknowledged as much in their discussion of SB349 which contains a similar piece of legislation. The House has a different approach based on increased Homestead Exemption rates. These two bills have yet to be combined into a bill that both Houses can support. These types of legislation actually provide an exemption to the true assessed value for one group of taxpayers. In this case, that would be citizens with Homestead Property who enter into and remain under the freeze conditions. Uniformity for taxable properties in the county will cease to exist.

Non- homesteaded property, land, rental properties and commercial and industrial properties are excluded and will be taxed at a higher comparable assessed value from those under the freeze. While this may seem reasonable to those under the initial freeze, it does not provide uniformity across all citizens of the county for tax purposes. As a simple example, if someone owns a home valued at $100,000 at the implementation of the legislation and their children, relatives or anyone wanting to buy their first home or upgrade from a starter home by buying or building that same house after the true Fair Market Value of the existing house has risen to $150,000 will be taxed at an assessed value of $150,000 while the freeze owner continues to be taxed on the $100,000 value for a comparable house. The homeowner under the freeze will be granted an exemption of $50,000 off of the current Fair Market Value. The freeze does not restrict the growth of true Fair Market Values. It simply provides an exemption to those under the freeze equal to the difference in the then current Fair Market and frozen values for tax purposes.

Additional implications of such a freeze in our county, where reasonable rental property is already difficult to obtain, could cause a detrimental effect on not only those seeking to rent but, those who provide rental property. By carrying a higher equivalent tax burden, people in that business have several options none of which benefit the renter. They can choose to raise rent, they can neglect doing appropriate up keep, absorb the increased tax burden or get out of the rental business.

The same holds true for the “mom and pop” businesses within the county. Builders and people associated with the home improvement work forces may also face a downturn in business as a result of the reluctance of people to upgrade to new housing modify existing housing or buy their first home here because of a disparity or non-uniformity in the tax structure.

In summary even though it could benefit me personally, I oppose a freeze simply because of the uniformity aspect. I believe everyone should pay a fair share of taxes, not more and not less, than everyone else in the county. Any bill that we approve should be uniform across all taxpayers and I do not believe this legislation meets that standard.

Again, I am no expert in this area and these are my opinions based on the above narrative. Each taxpayer will have research the bill, develop their own opinions and then vote their convictions on this legislation or any other similar legislation that comes out of the Georgia Legislature. I hope that the information provided is thought provoking and gives any reader a starting point for an individual evaluation of the legislation.

John Bailey

Chattooga County Sole Commissioner is urging citizens to vote yes for the legislation. “VOTE YES – to my Local Homestead Exemption Freeze legislation that allows anyone with a homesteaded property to freeze their assessment from going up. This will be on the May 21st ballot,” Elsberry posted to his Facebook page.