Many Chattooga County residents had sticker shock when they opened this year’s tax assessment.

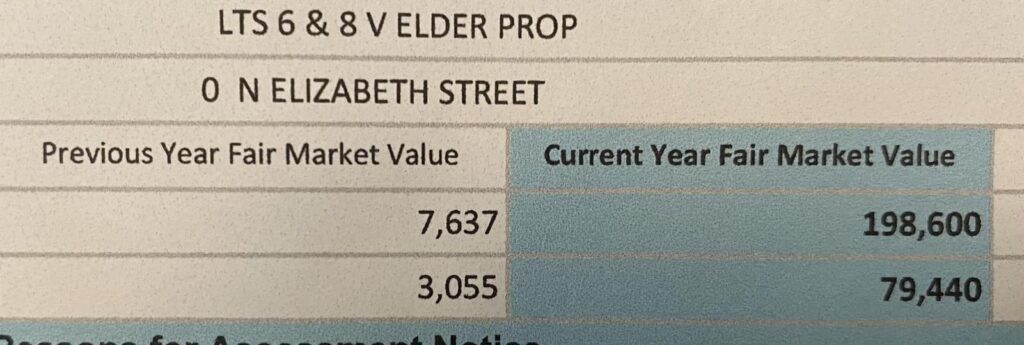

Some property in the county increased by as much as $30,000.00 an acre. It has been common to see 50%, 75%, and even 100% increases. One property owner was hit with a 2,600% increase for land in a flood plain.

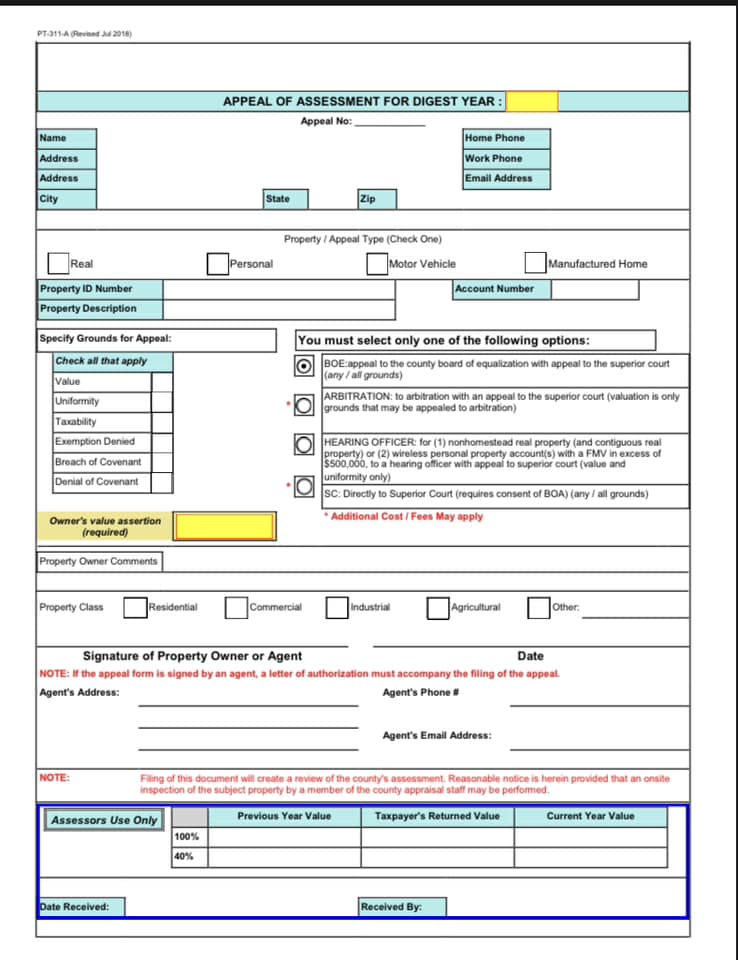

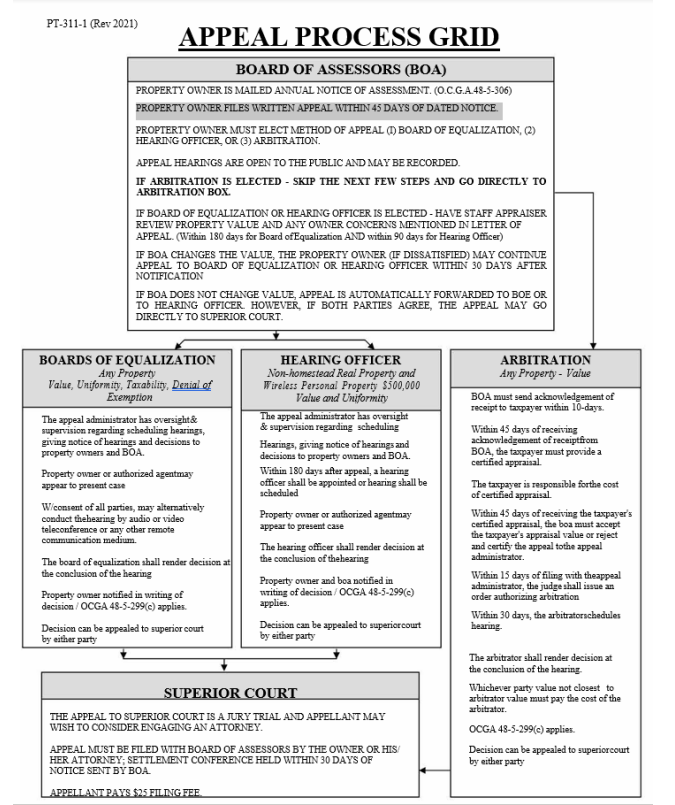

People are frustrated and looking for answers and help. The only option the tax assessors office is offering is to appeal.

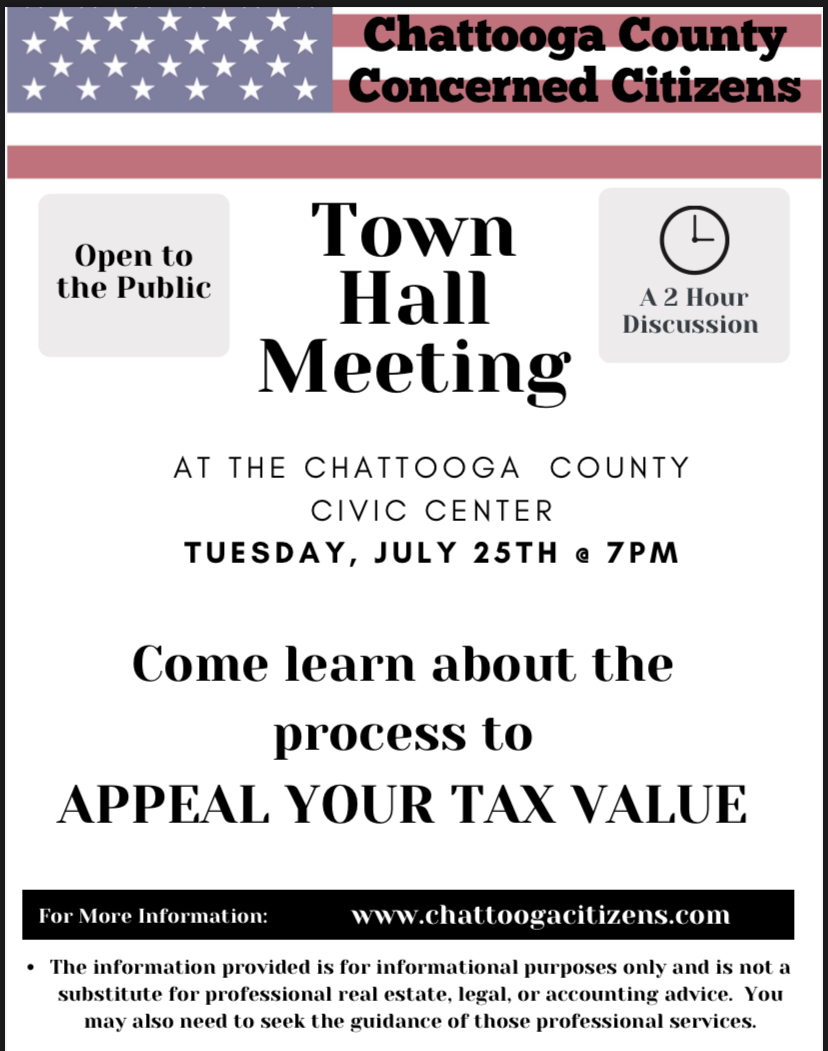

A Town Hall meeting will be held Tuesday, July 25th, at 7 p.m. at the Chattooga County Civic Center to help those who want to appeal their tax assessments.

“I helped my mom file an appeal last year. Neither of us had ever had to do anything like that before. There were many things I wish I had known before going in front of the board. I hope that by having this meeting, we can make everyone more prepared to have a positive outcome,” organizer Ben Housch said.

“Myself along with many others have never been through an appeals process and we hope this educational experience will help with an easy and successful process,” organizer Andy Allen said.

At the town hall knowledgeable people with experience will discuss the appeals process for Property Tax Valuations. Attending would be well worth your time if you’ve never done an appeal before and would like to know more about it.

Appeals do work, sometimes. But there is a process.

Last year Chattooga County had a total of 193 appeals filed. The Board of Assessors heard all, and 62 were reduced totaling $1,369,584. 127 appeals were certified to the Board of Equalization. 98 appeals were heard by the Board of Equalization. 29 were withdrawn from the Board of Equalization. 11 were reduced totaling $229,490.

Who exactly did these assessments: The county used a company to ASSIST with assessments called Georgia Mass Appraisal Services & Solutions, Inc (GMASS) gmass.net from Norwood Georgia. The DATA was collected by the Assessors office within a two year time frame. The cost for their work was $69,250.00.