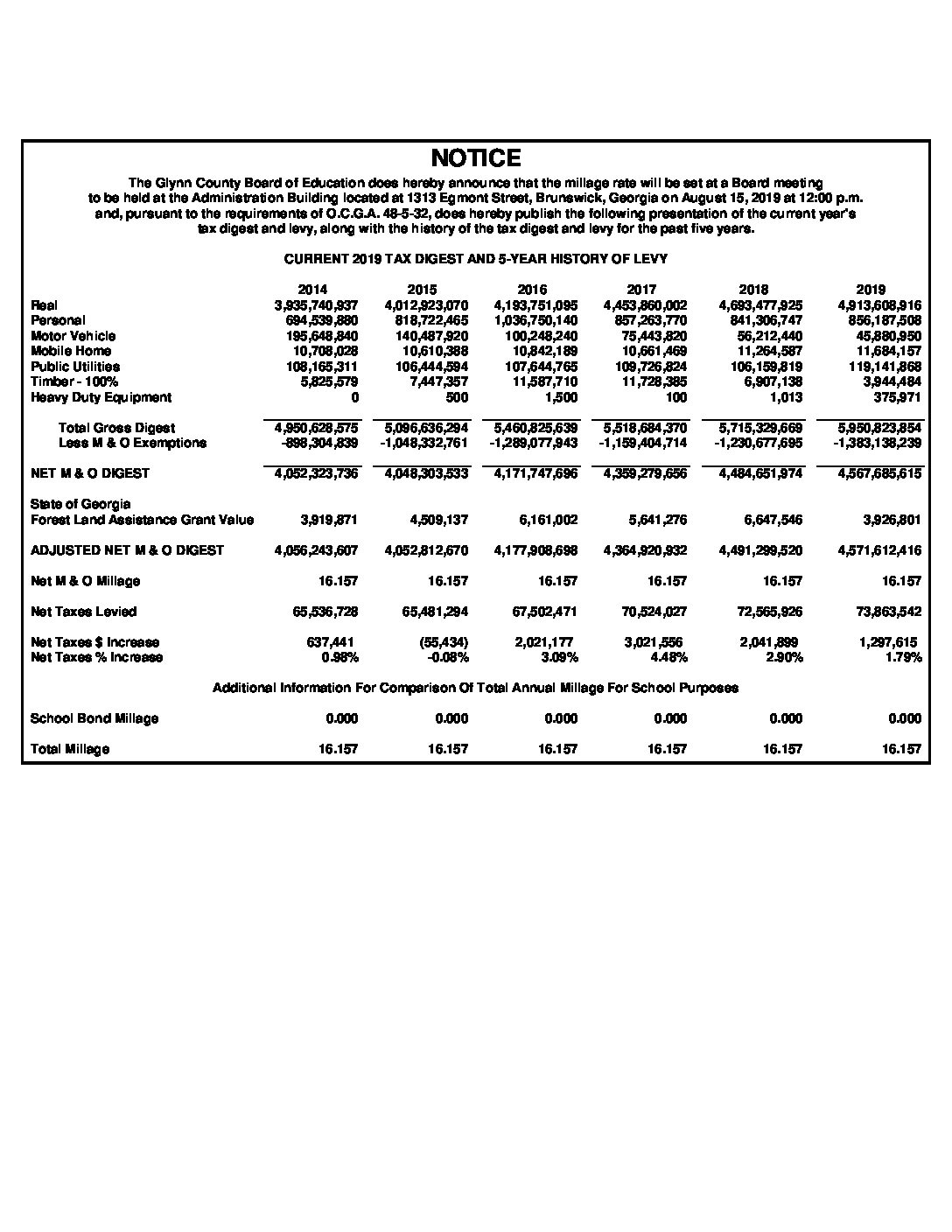

The Glynn County Board of Education has tentatively adopted a millage rate which will require an increase in property taxes by 1.61 percent.

All concerned citizens are invited to the three public hearings on this tax increase. The first public hearing will be held at 6:00 p.m. on Thursday, August 8. The second public hearing will be held at 9:00 a.m. on Thursday, August 15. The third and final public hearing will be held at 12:00 p.m. on Thursday, August 15. All three public hearings will be held at the Glynn County School System Administration Building, 1313 Egmont Street, Brunswick, Georgia.

Following the third and final public hearing, the Glynn County Board of Education will adopt the 2019 millage rate at a Special Called Board meeting on Thursday, August 15 at 12:00 p.m. The Board meeting will be held at the Glynn County School System Administration Building, 1313 Egmont Street, Brunswick, Georgia.

This tentative increase will result in a millage rate of 16.157 mills, an increase of .256 mills. Without this tentative tax increase, the millage rate will be no more than 15.901 mills. The proposed tax increase for a home with a fair market value of $225,000 is approximately $57.60 and the proposed tax increase for non-homestead property with a fair market value of $250,000 is approximately $64.00.